- Domestic energy production that is independent of the weather and neighbours is as important to the country as domestic agriculture and national defence.

- Electricity prices are consistently favourable for both large and domestic consumers, as it replaces more expensive fossil energy.

- Predictable and affordable electricity will give our industry a competitive edge in global export markets, and will help create new businesses and jobs in Estonia.

Nuclear power plant offers low-cost electricity at a fixed price to residential customers

Fermi Energia plans to sell its electricity to residential customers on long-term fixed-price contracts, targeting electricity prices in the range of €75-80/MWh.

If the consumer hasfixed price contract, the price per kilowatt-hour of electricity is fixed and the price per kilowatt-hour on the electricity bill is the same every month.

Today's multi-year 100% green electricity 3 to 7 year electricity sales prices are around 120-130€/MWh.

Nuclear power plant output also helps to bring down electricity market prices

Electricity produced by the nuclear power plant Pushes expensive fossil fuel power plants out of the market. As nuclear power generation is not dependent on weather conditions and guarantees continuous electricity generation 24/7 at full capacity, market price volatility is reduced. (price fluctuations over a certain period of time). This will also benefit consumers who opt for an exchange package.

In an open electricity market, or electricity exchange, the price of electricity is determined by supply and demand on an hourly basis. In the Nord Pool open electricity market, electricity producers from Estonia, Latvia, Lithuania, Finland, Sweden, Norway and Denmark trade. Electricity prices vary from country to country due to limited transmission capacity between countries. 2024 a. Finland-Estonia electricity transmission fee per 1 MWh auctioned 30€ / MWh (in 2023 there were 23€ / MWh).

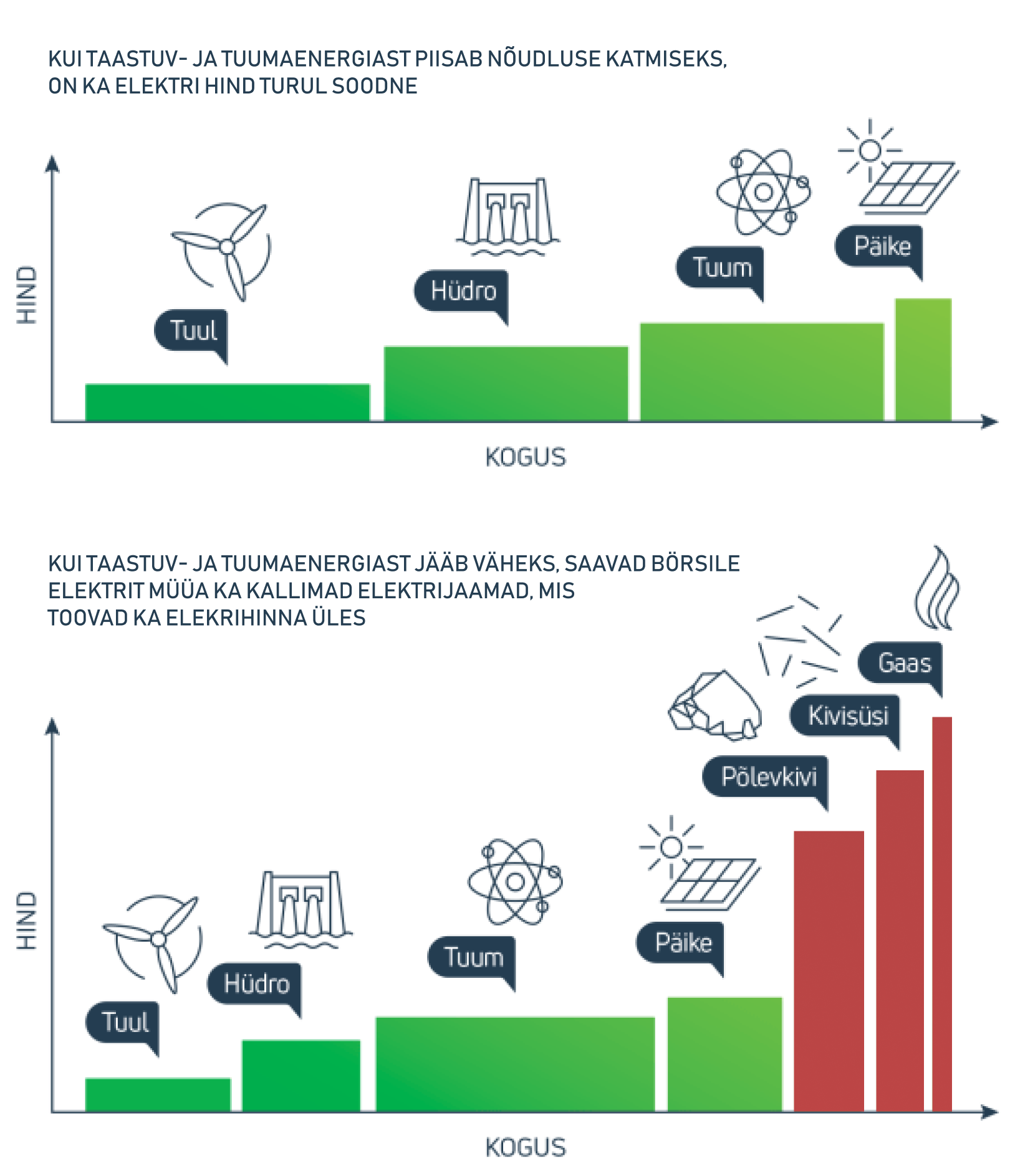

Renewable and nuclear units will be the first to enter the market to meet demand. Their production is cheaper because the energy sources are cheap and the production does not produce carbon dioxide. If renewables and nuclear power are sufficient to cover consumption, the electricity price on the market is favourable.

If renewables and nuclear power do not meet demand, shale, coal and gas power plants will enter the market. Their electricity is more expensive in terms of both fuel and CO2 because of the emissions levy.

The electricity exchange price is set by the last bidder. For example, if the last to cover the market demand is a gas-fired power plant, which has a higher price, it will set the price for that particular hour of electricity. If the latter covers market demand nuclear plant, the price is favourable.

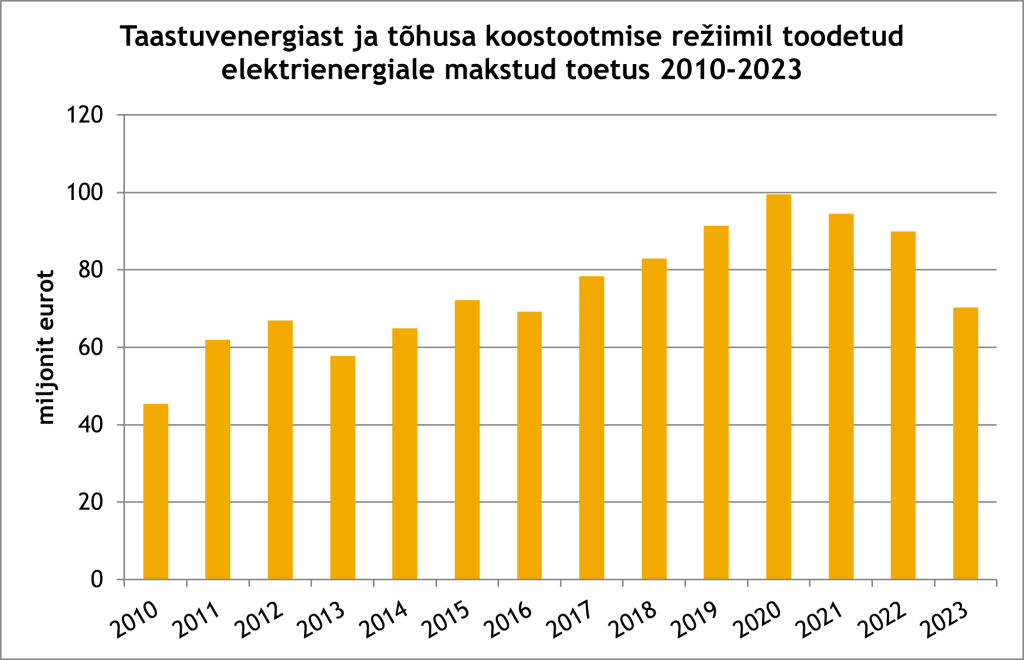

Did you know that, unlike renewables, nuclear energy does not require additional production subsidies from the taxpayer?

- Some OL3 reactors were built without public support.

- The renewable energy fee collected by Elering and paid to producers will be 1.28 cents/kWh (12.8 €/MWh) in 2024.

- The distribution of the 2024 renewables allocation is expected to be as follows:

- 35% to support wind energy,

- 33% to support electricity from biomass and biogas,

- 32% to support solar power plants.

- The estimated amount of support for renewable energy production (1649 GWh) is €88.5 million.

- Two 300MW small reactors could produce over 4000 GWh per year without subsidies.

Estonian nuclear power plant improves Estonia's export capacity

Fermi Energia's business plan forecasts that the share of industrial customers should be 60-80 percent. This will provide an opportunity for the Estonian economy to develop, while at the same time there will be enough electricity to supply the electricity market at a favourable price. To date, contracts have already been signed Advance agreements for the sale of electricity at a fixed price. 96 Estonian companies with a total consumption of 500 GWh. Fermi Energia aims to cover 4.8 TWh through long-term forward sales contracts, first with Estonian and then with Latvian and Lithuanian industrial customers.

Predictable and affordable electricity will give our industry a long-term competitive advantage in global export markets and will encourage the creation of new businesses and jobs in Estonia.

Source: Elering

Why is electricity getting more expensive?

As of 2019, electricity has become one of the biggest energy sources in Estonia. for imports. According to Statistics Estonia, Estonia's net imports of electricity amounted to 206 million euros in the third quarter of 2023. This amount represents the value added, high-paying jobs and tax revenue not generated in Estonia. Source: Estonian Statistical Office

On 3 January 2024, there was a shortfall of 300-600 MWe of electricity generation capacity in Estonia. If we had had 300 MWe of nuclear power, we could have avoided sending €720 000 abroad. With 600 MWe, we would have been able to keep €1 440 000 at home.

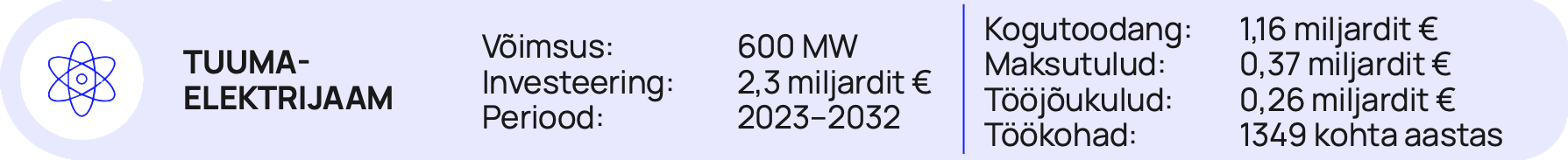

An analysis of the economic impact of the plant carried out by the Centre for Development Monitoring (DCM) showed that, for the period 2023-2035, taking into account both the construction and the production period, it is expected that. Follow impacts:

Source: Development Monitoring Centre

Estonian nuclear power plant ensures Estonia's security of supply

Given Finland's own rapid growth in electricity consumption (projected at 125 TWh by 2033, 47 TWh more than in 2023), but at the same time the reduction of firm generation capacity (coal plant closures) and the increasing share of weather-dependent unregulated capacity, it is difficult to prove that Finland can also ensure security of supply for Estonia and the Baltic States in the winter with wind. via Estlink 1, 2 or 3.

The beginning of 2024 shows that in the event of a cold winter and daily winds, Finland itself will lack firm generation capacity (2.6 GW of imports) and will probably not be able to contribute to security of supply in Estonia and the Baltic States. Firm generation capacity in Estonia is a more effective guarantee of security of supply than external interconnections, which are demonstrably vulnerable.

Food security, jobs and local progress in addition

A nuclear power plant produces not only electricity but also heat. Fermi would be able to provide nearby settlements (up to a radius of a few dozen kilometres) with raw heat several times cheaper than today. In Switzerland, for example, nuclear plants provide district heating to private houses within a 12 km radius at a price of €10/MWh. In Estonia, we can now estimate that we could provide district heating at a price of around €30/MWh, more than twice the regulated price in Kiviõli, Sillamäe and Narva.

In addition to electricity and heat, the plant will create 200 direct jobs in the region, with average wages at current levels of around €4,000. This means direct income tax revenue for the municipality of ca €800 000 per year. In addition, around 100 indirect jobs will be created, as the plant will require a range of services similar to those in the oil shale sector.

But why not build a nuclear power plant in Finland?

- There are currently no definite development projects for new nuclear power plants in Finland, so it can be expected that no new nuclear plants will be built in Finland in the next 10 years. The Finns have not once expressed any interest in a joint nuclear power plant project.

- The impact of a nuclear power plant in Finland on electricity prices in Estonia will only be felt in certain hours, when there is still spare capacity on the Finnish-Estonian transmission. At other times, the nuclear power plant in Finland is of no use to Estonian consumers. This is reflected in a cross-border price gap of €30/MWh in 2024. It also does not provide Estonian customers with long-term access to cheap and stable electricity. The average price difference between Some and Estonia in 2023 was 34%. €/MWh.

- Submarine cables are vulnerable. The nuclear power plant to be built in Finland will transmit electricity through existing submarine power cables, which are easily vulnerable in the past. For example, in 2023, the Baltic undersea infrastructure was severely damaged: the BalticConnector gas pipeline and the Estonian-Finnish and Estonian-Swedish communication cables.